LINE Pay Taiwan's Strategy for the Next Stage After Its Listing on the Taiwan Stock Exchange

LINE Pay Taiwan Limited (hereafter, LINE Pay Taiwan), a subsidiary of LY Corporation, which offers LINE Pay in Taiwan, became listed on the Taiwan Stock Exchange on December 5. This is the first time a company providing a LINE brand service outside of Japan offered stock to the public.

Seizing this milestone, the LY Corporation Story team conducted an interview with LINE Pay Taiwan Chairman and CEO Jeong and Senior Vice President Gloria. They talked about how they feel at having just achieved listing on the Taiwan Stock Exchange and their enthusiasm for future business expansion.

Also, an earnings presentation was held on November 12 before the stock market listing where over 400 business partners, members of the local media, and investors were invited. Footage of this event is provided in a highlight video at the end of this article.

- Jeong Woong-Ju

- LINE Pay Taiwan Limited Chairman and CEO

Jeong has received a Master's Degree in Computer Engineering from the Yonsei University in South Korea. After joining LINE Corporation in 2013, Jeong was overseeing LINE Pay Corporation's global business as the company's Chief Operating Officer (COO) when he was commissioned to recover LINE Pay Taiwan's business performance that was lagging behind the other markets. Jeong has been serving as LINE Pay Taiwan's chairman since 2016 while also serving as director for several group companies including LINE Financial Corporation, LINE Pay Plus Corporation, and LINE Bank Taiwan Limited.

- Yuk Young-Hwa (Gloria)

- LINE Pay Taiwan Limited Senior Vice President

Gloria majored in Chinese at Yonsei University in South Korea and received a master's degree from Hankuk University of Foreign Studies Graduate School of Interpretation and Translation. In 2018, she joined LINE Pay Taiwan and worked on projects such as market research, business expansion, and strategy promotion as Jeong's assistant. As Senior Vice President, she currently oversees managerial support and works for the board of directors, public relations, and investor relations. She leads various important projects to achieve the company's strategic goals, including the recent stock market listing.

Overcoming challenges to be listed on the Taiwan Stock Exchange

――Congratulations on being listed on the Taiwan Stock Exchange. Please tell us what was particularly difficult about the process leading to the listing.

Jeong:

We applied for an IPO in November 2023. Just two months after that, we were listed on the Emerging Stock Board (ESB*1) and received approval this October for listing on the Taiwan Stock Exchange. This was exceptionally fast, even among Taiwanese companies. However, we did have to overcome several issues in the process to being approved, and it was quite a difficult path.

Gloria:

First, we needed to meet the financial standards, which required maintaining financial growth over the past three years without incurring deficits. Maintaining stable financial growth while not just expanding the business was an extremely important issue for the company. Amidst a rapidly changing market environment, maintaining business expansion and financial stability at the same time ended up being a great challenge for us.

In addition, since the parent company, LY Corporation, is already a listed company, the subsidiary, LINE Pay Taiwan, was put through an even stricter review. We needed to prove that we operate independently from the parent company and have sufficient unique value. We were also strictly required to prepare an internal control system and corporate governance criteria, as well as show transparency in information disclosure and accuracy in financial reporting. To achieve these objectives, we have made significant efforts in the management and operation of the company.

*1 A market that handles stocks of companies before they are listed on Taiwan's stock exchange.

LINE Pay Click here for the article regarding LINE Pay Taiwan's listing on the ESB.

――You overcame a lot of issues and realized your listing on the Taiwan Stock Exchange. How do you feel now?

Jeong:

I am filled with a sense of achievement that our efforts leading up to this bore fruit and we were able to succeed at being listed on the Taiwan Stock Exchange. LINE Pay Taiwan staff are delighted to be members of a listed company. Seeing their joy brings me immense satisfaction and am very proud to have worked alongside them to accomplish this significant goal.

LINE Pay Taiwan is the only mobile payment provider in Taiwan to maintain profitable growth over the past few years. There were concerns in the market and among investors about whether further growth is possible and whether it is worthwhile to invest if future growth cannot be expected. I think our recent earnings presentation was a good chance for us to be able to convey to investors and the media how LINE Pay Taiwan has achieved growth thus far and the potential it has for growth using a variety of data.

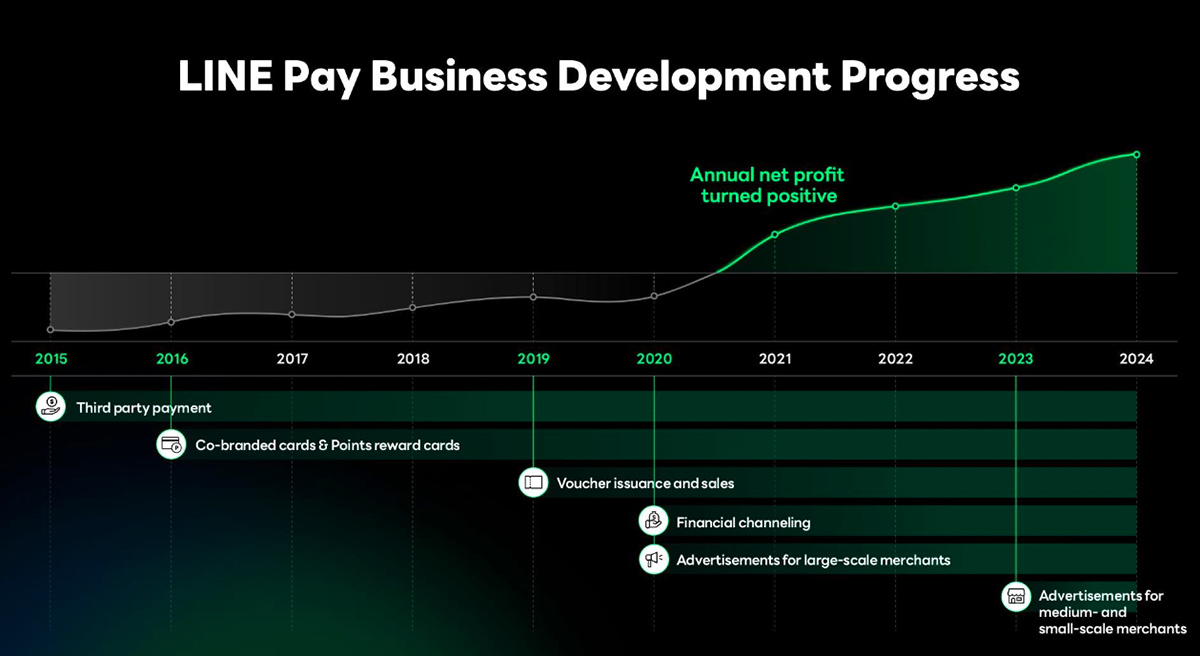

History of the LINE Pay Taiwan business: It began operating in 2015 and experienced losses initially, but its annual net profit turned positive in 2021.

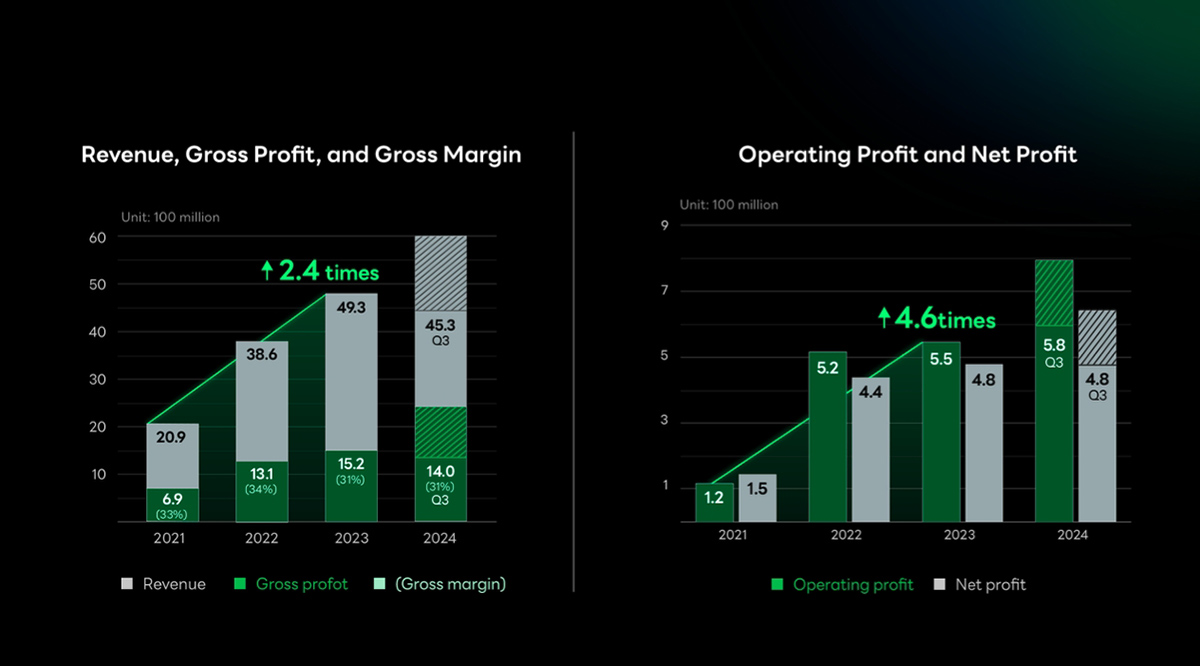

From 2021 to 2023, revenue, operating profit, and net profit all increased.

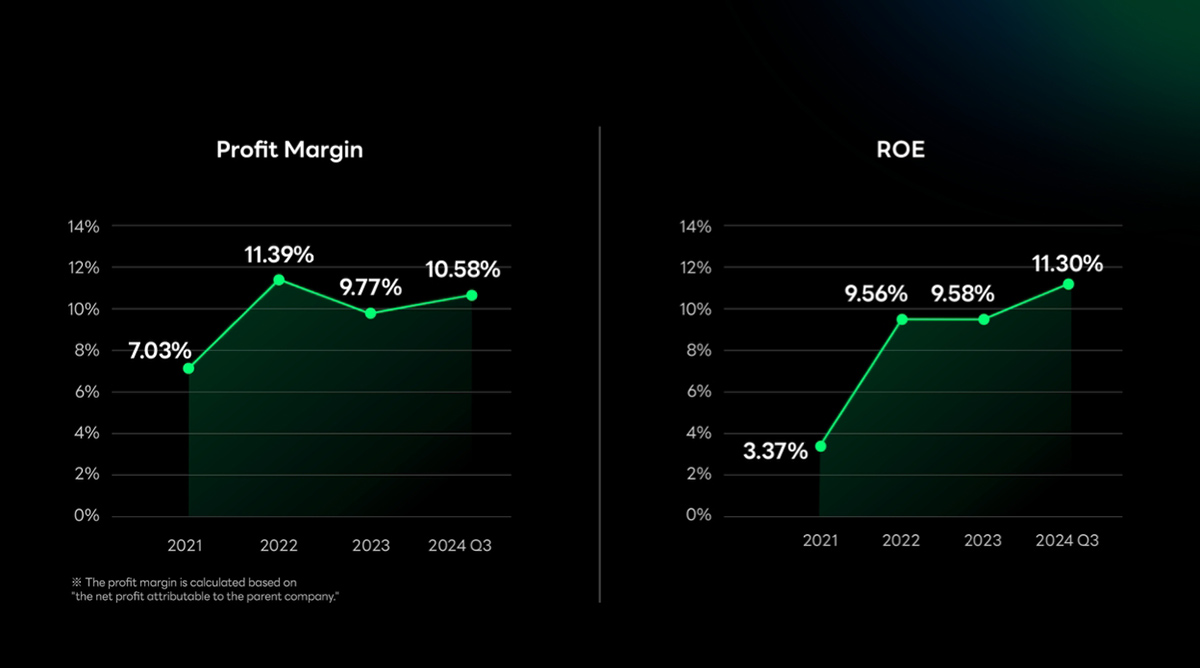

From 2021 to the third quarter of 2024, profit margin and return on equity both continued stable growth. (Although the profit margin temporarily dropped in 2023 due to preparations for the listing and other factors, it recovered to 10.58% in the third quarter of 2024.)

Refining the platform while aiming for further growth in Taiwan

――Tell us about the future strategy for LINE Pay. First, please explain the growth strategy for the Taiwanese market.

Jeong:

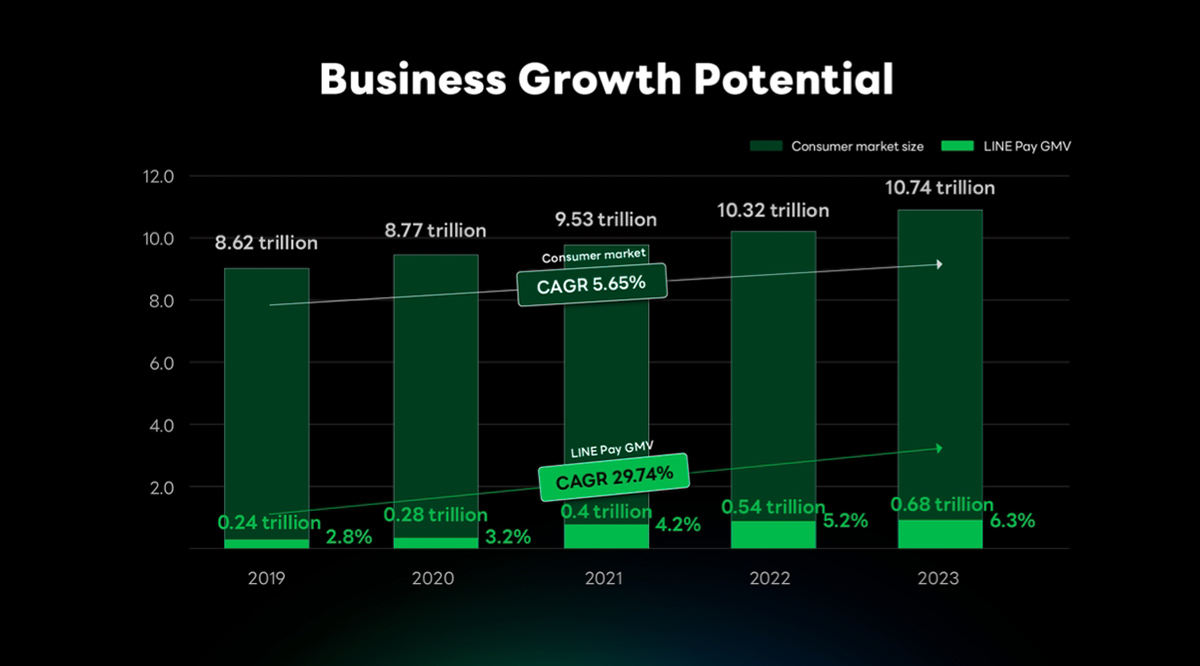

As of the third quarter of 2024, the number of LINE Pay users in Taiwan reached over 12.7 million, which is over half of Taiwan's population. Also, the number of points-of-sales, such as restaurants, retail centers, amusement facilities, and means of transportation, surpassed 570 thousand(*2). LINE Pay's GMV was over four times that of the total of Taiwan's digital payment providers(*3), and the number of transactions continues to grow. However, LINE Pay's GMV was only 6.3% of the total of the Taiwanese consumer market in 2023. This indicates that LINE Pay Taiwan has room to grow in the Taiwanese consumer market.

*2 This is about three times the number of merchants of Taiwan's largest acquiring bank. An acquiring bank is a bank or financial institution that makes contracts with merchants to process credit cards and debit card payments.

*3 Providers that have an EPI (electronic payment institution) license and enable users to link credit cards or bank accounts for payments or transfer. LINE Pay Taiwan is a third-party payment provider that offers a service to pay by linking credit cards.

As of the third quarter of 2024, LINE Pay Taiwan's achievements include having over 12.7 million users and 570 thousand points-of-sales, as well as having over 18.3 million registered cards and over 8 million points reward cards issued.

Chart illustrating the potential for LINE Pay's business growth in the Taiwanese market: LINE Pay's GMV in 2023 was just 6.3% of the total Taiwanese consumer market, which means there is still the potential for growth in the Taiwanese market.

Jeong:

Over half of LINE Pay Taiwan merchants are small and medium enterprises (SMEs), and we have developed the "LINE Pay Marketing Platform"aimed at such businesses. In the future, I want to aim for further growth in the Taiwanese market by strengthening this platform even more and expanding our SME-focused business.

SME merchants are all over Taiwan, and it is difficult for us to support them directly on a daily basis, so I want to provide a simple and affordable platform that SME merchants themselves can use. We are working to develop a marketing platform that is easy for various SMEs to use while making use of the marketing features LINE Pay Taiwan already has, incorporating user feedback, and conducting detailed analysis. We proactively make use of LINE Pay Taiwan's business locations across Taiwan to increase awareness of this platform.

We have built up a lot of strength over the last 10 years. I believe we can use this strength as the basis to achieve even greater growth in a shorter period than ever before.

Expanding into the global market with a strategy that leverages the strengths of LINE and LINE Pay

――Moving on, please tell us your strategy for expanding into the overseas market.

Jeong:

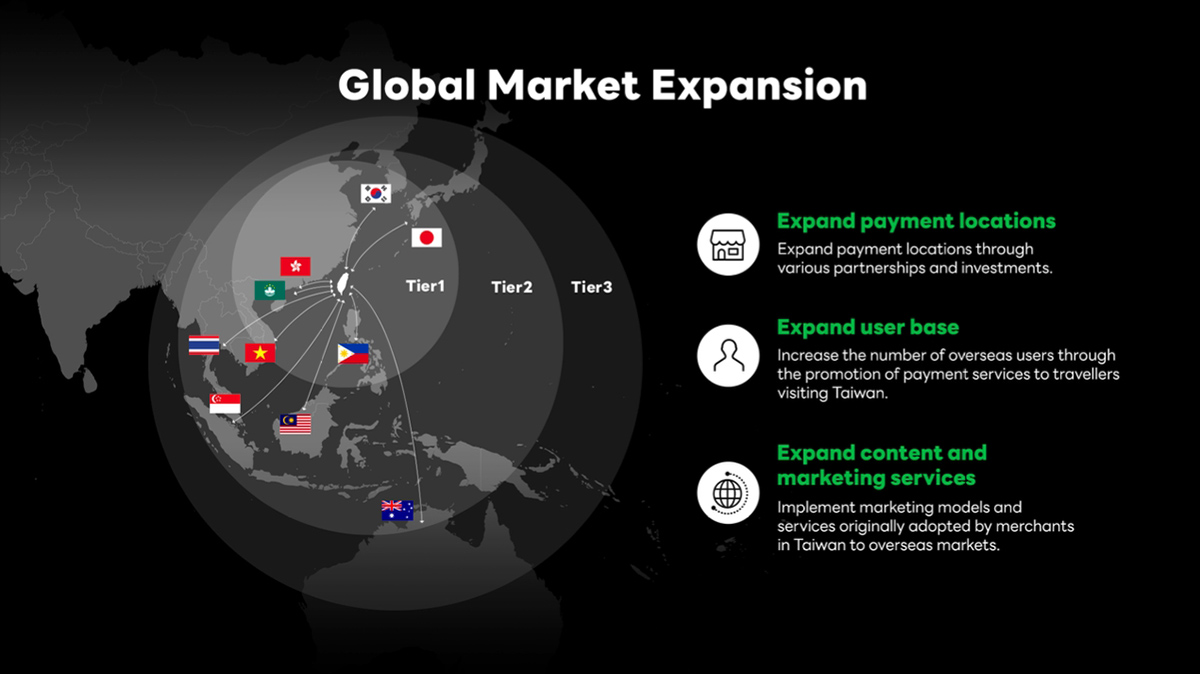

I feel that now is an excellent time for developing the global market while expanding our business in the Taiwanese market at the same time. LINE Pay's operations overseas are not that different from our operations in Taiwan. Our goal is to expand the user and merchant base we have established in Taiwan to international markets. This involves not only enlarging our user and merchant network, but also offering valuable content to global users and constructing cross-border services and payment systems to deliver more competitive international services.

Gloria:

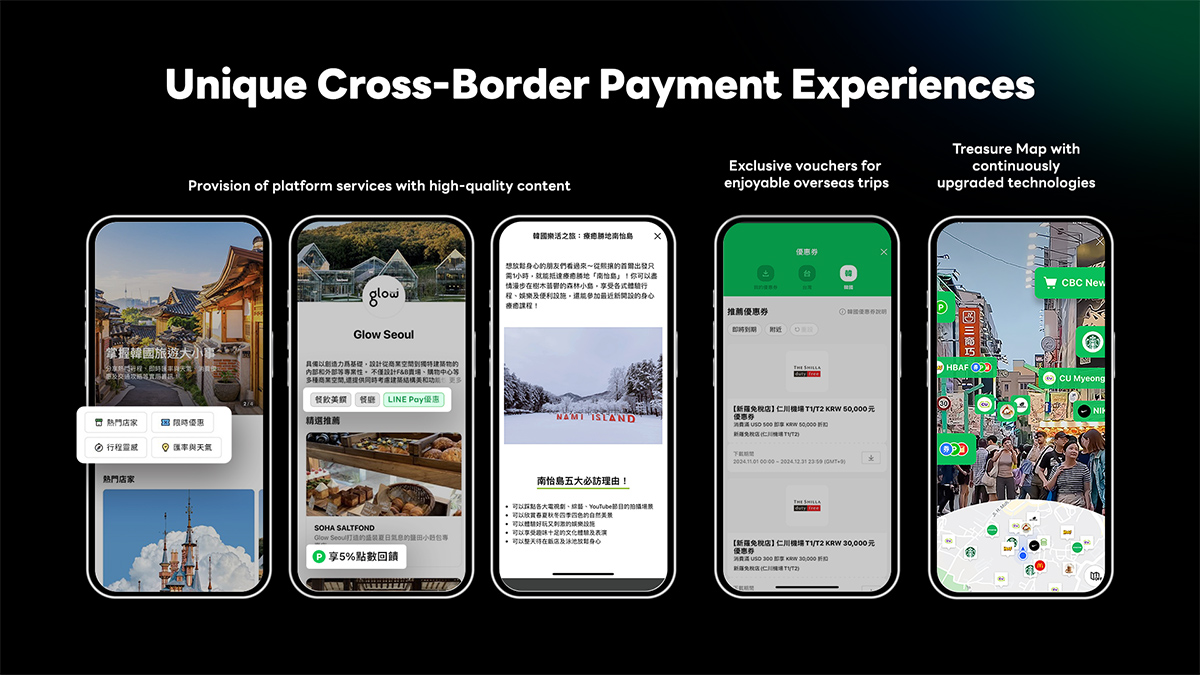

Specifically, we are providing an inbound and outbound payment service by joining forces with "Shinhan Card", Korea's largest credit card company, in November 2023 and with various merchants, such as "CU," "SAMSUNG C&T," "INNISFREE," and including "Shilla Duty Free," one of Korea's representative merchants, from July 2024.

Through this, users visiting Taiwan from Korea became able to use the LINE Pay service to make payment at LINE Pay merchants through their Shinhan Card app, and users from Taiwan also became able to use LINE Pay to pay when shopping at Shilla Duty Free during trips to Korea. In addition to enabling cross-border payments, we strive to enrich the users'stay by offering information on popular local stores, special offers, and treasure maps in the users'native languages.

Cross-border payment service screens: Users can check information about popular local stores and special offers in their native languages.

――What was the background that led to offering this service?

Jeong:

In general, when mobile payment businesses expand overseas, they give the highest priority to expanding merchants. While we also aim to expand our merchants in overseas markets, I believe that this alone is not enough. To become a market leader, we need to adopt a uniquely innovative strategy that goes beyond the ordinary.

For example, even if there are millions of merchants across Japan, it is hard to imagine that users from Taiwan will use all of them. I think that we should target shopping areas, such as tourist sites and duty-free stores, that many users visit. Also, while people taking trips overseas are eager to spend money, they are also keen to avoid unnecessary expenses. Therefore, I think we need a strategy that provides them with a sense of value and savings.

Also, LINE Pay Taiwan has repeatedly held promotions where we give LINE POINTS to users in Taiwan, which they can use like cash. As a result, users in Taiwan tend to favor receiving LINE POINTS even more than cash. There is a culture of bragging about one's saved points in online communities, which has even been featured by the media. Because the Points accumulate on users'smartphones, they are easily used in subsequent purchases. Consequently, the LINE POINTS usage rate in Taiwan reaches around 100% every year.

Taking these factors into account, we put to use LINE's content creation ability and language support features, as well as the marketing expertise developed through LINE Pay to enable users to check a variety of local information in their native languages and also earn LINE POINTS. In the future, we plan to make use of AR and AI technologies, operate 3D maps, and provide valuable content that is more intuitive and immersive.

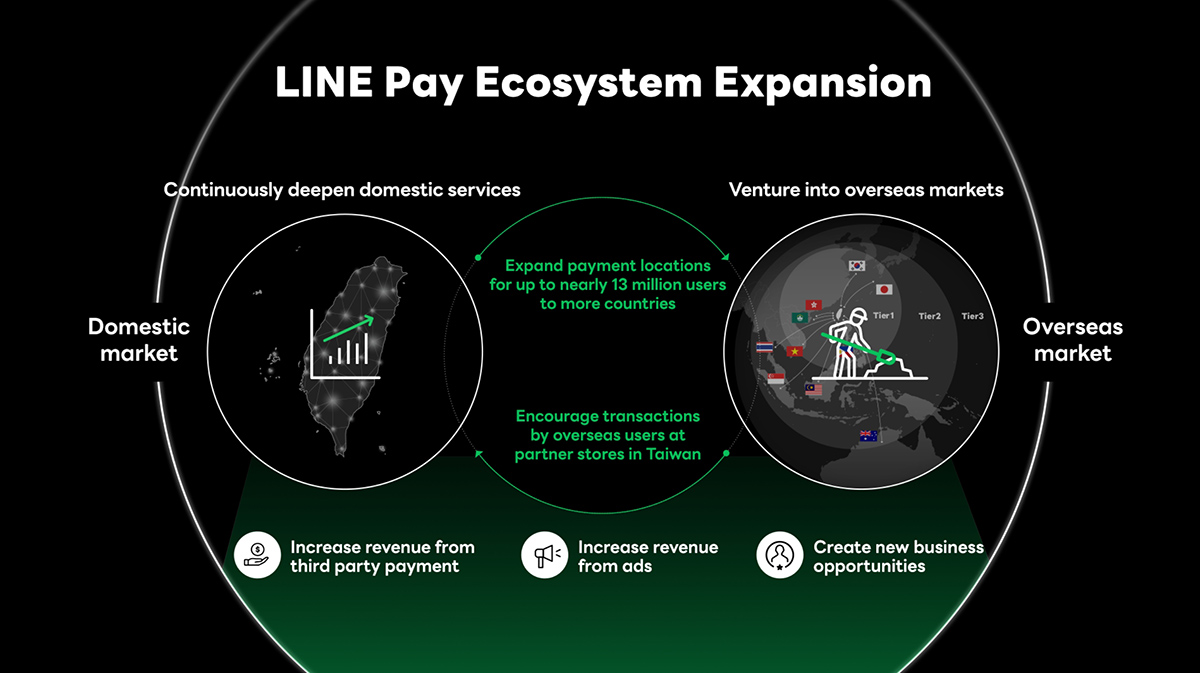

We are proceeding with expanding in other countries while first aiming at growing our service in Korea. If we can deliver a certain level of results in the overseas market, I think that those results will conversely drive profits for merchants in Taiwan, too. I want to create the ecosystem we have built up over the past 10 years in Taiwan in the overseas market, too.

Diagram of LINE Pay Taiwan's business expansion into global markets: The company aims to increase payment locations and overseas users, while also expanding Taiwan's marketing model and services overseas.

Corporate responsibility to initiate a virtuous cycle for society

――How do you want LINE Pay Taiwan to affect society in the future?

Jeong:

Since our service launched in 2015, we have offered various services and affected society in many ways. For example, when the 2016 southern Taiwan earthquake occurred, LINE Pay Taiwan offered the first service in Taiwan allowing donations with credit cards. At the time, it was common for donations to be made with cash, and it was considered a burden by many to line up for a long time in front of convenience stores to donate. However, with our service, users became able to make donations easily with their credit cards, and we collected a lot of contributions.

This is one big instance where LINE Pay Taiwan was able to have a positive effect on users' lives and Taiwanese society. It contributed greatly to the culture of charity in Taiwan, and we received a certificate of appreciation from the Taiwanese government.

I think that businesses should take up a role in making society even just a little bit better. I strongly believe that it is important to use the profits we earn from business to contribute to the marketplace and society. I would like to build a virtuous cycle like this in Taiwan.

Gloria:

LINE Pay Taiwan has grown into a company that currently has around 420 employees, but at that time we did not have as many people, and we worked late every night giving all our energy to develop the donation platform. They were truly tough days, but thanks to our efforts, we were able to collect a lot of donations and contribute to society. I am very happy and proud of this.

In the future, we plan to expand this donation platform further. I want to create a structure for collecting donations for various fields, not just contributions for earthquakes, by working together with various organizations.

Also, I think it is very important to strengthen our environmental, social, and governance (ESG) efforts as a listed company. Recently, we have been conducting awareness campaigns toward employees regarding the environment, and we have set up LINE Pay Taiwan business locations in various cities. Through this, I think we can bring about a sustainable society and contribute to regional employment. I want to think about how we can proactively fulfill our social responsibilities as a listed company into the future.

Becoming a worldwide platform provider integral to people's lives

――Finally, please tell us the vision of LINE Pay Taiwan.

Gloria:

As a person responsible for investor relations, I think it is important for the company to always continue growing in order to be recognized by the market, as well as domestic and foreign investors. In the future, we are going to expand the business not just in the Taiwanese market, but in the global market, and continue to provide services rooted in users' lives. At the same time, we are aiming to increase information transparency, strengthen communication with domestic and foreign investors, and become a trusted business.

Jeong:

The main role for LINE Pay Taiwan is to connect users and merchants. I think this B2B2C(*4) business model is very important and valuable. In the end, we want to become an entity which provides a platform worldwide. We will produce new value with our payment service as our foundation, then provide that value to our partners, merchants, and users. We call this being a global marketing platform provider.

In addition, beyond merely being a payment intermediary, we aspire to become a company that provides original solutions. We aim to be an essential provider of solutions in our ecosystem, where partners, merchants, and users actively engage. Our vision is to become an integral part of the lives of all our partners, merchants, and users. By providing essential solutions to our lives, I think we can secure business sustainability for LINE Pay Taiwan. Ultimately, I think this is the ecosystem we should build.

For us, this listing is nothing more than a new starting line. We are aiming to be a business that builds a better society and can grow stably for the next 10 or 20 years without forgetting our vision of becoming part of people's lives.

*4 Business to Business to Customer is a business model where a company provides goods or services to end consumers through another company.

Diagram of the ecosystem envisioned by LINE Pay Taiwan: It involves expanding business both domestically and abroad and increasing cross-border transactions. The goal is to expand earnings from third party purchases and advertising revenue, paving the way for new business opportunities.

Scenes from the earnings presentation participated by over 400 members of the local media and investors

From here, we will introduce some scenes from the earnings presentation held prior to the public listing.

Entering the presentation venue, a "7722" commemorative installation jumps into view. This was made in commemoration of the listing, and shows LINE Pay Taiwan's securities code. LINE Pay Taiwan's management took a commemorative photo here. (From left: Senior Vice President: Celeste; Executive Vice President: Harris; Chairman and CEO: Jeong; Senior Vice President: Gloria; Finance and Accounting Manager: Reffy)

Inside the venue, a board detailing LINE Pay Taiwan's history and demonstration devices were on display, allowing guests to find out about how LINE Pay Taiwan has progressed and the service.

At the start of the presentation, the President of the Taiwan Stock Exchange, Edith Lee, and the Chairman of KGI Securities, Daw-Yi Hsu, gave congratulatory speeches.

LY Corporation Chief Product Officer (CPO) Jungho Shin, (bottom left photo) also gave a congratulatory speech, expressing his happiness at LINE Pay Taiwan becoming a listed company and his expectations for the future. Following this, the management gave an explanation about LINE Pay Taiwan's history and its vision for the future.

For a video of the event and resources from the stage, see here.(Resources only available in English and Traditional Chinese.)

Also be sure to see footage from the event in the highlight video provided below

Related Links

Interview Date:November 13, 2024

*The affiliations and titles in the article are as of the time of the interview.

- About The LY Corporation Story

- Making daily life more convenient and exciting for everyone.

As our corporate blog, The LY Corporation Story will share the inside story behind the challenges that we take on to create WOW! as well as the thoughts and feelings behind them.