LINE Pay: Why It's Popular in Taiwan, How It Became the Most Popular Payment Service in the Taiwanese Market, and the Company's Challenges in Going Public

LINE Pay Taiwan Limited, an LY Corporation Group company and provider of Taiwan's number one mobile payment service (*1) LINE Pay, became registered on Taiwan's Emerging Stock Board (ESB *2) on January 26, 2024. The company intends to expand its business operations as it prepares to go public in Taiwan.

To learn more about how people in Taiwan use LINE Pay and how the service came to become the Taiwanese market's most popular mobile payment service, we spoke with LINE Pay Taiwan's Chairman and CEO Jeong Woong-Ju on LINE Pay's business history, service specifications that are unique to the Taiwanese market, and what it means for LINE Pay Taiwan to become a publicly traded company.

*1 Based on research conducted in September 2023 by Money 101, a Taiwanese financial instrument comparison platform.

*2 Where unlisted shares not yet available on the Taiwan Stock Exchange or the Taipei Exchange are handled. Here, companies increase their transparency and recognition as well as prepare for future growth.

After trading for six months on the ESB, companies become eligible to apply for listing on the Taiwan Stock Exchange or Taipei Stock Exchange.

- Jeong, Woong-Ju

- LINE Pay Taiwan Limited Chairman and CEO

Jeong has received a Master's Degree in Computer Engineering from the Yonsei University in South Korea. After joining LINE Corporation in 2013, Jeong was overseeing LINE Pay Corporation's global business as the company's Chief Operating Officer (COO) when he was commissioned to recover LINE Pay Taiwan's business performance that was lagging behind the other markets. Jeong has been serving as LINE Pay Taiwan's chairman since 2016 while also serving as director for several group companies including LINE Financial Corporation, LINE Pay Plus Corporation, and LINE Bank Taiwan Limited.

One in every two people living in Taiwan use LINE Pay

――Please tell us about LINE Pay usage in Taiwan.

As of April 2024, LINE Pay is accepted at more than 520,000 locations in Taiwan including restaurants, shopping malls, recreational facilities, and public transport, making LINE Pay the Taiwanese market's number one mobile payment service in terms of merchant coverage, market share, and mindshare.

In 2023, LINE Pay already had more than 12 million users in Taiwan. That's equivalent to one in every two people. The number of LINE Pay transactions was exceeding 920 million in this year, meaning every 0.03 seconds someone in Taiwan is using LINE Pay to make a transaction.(In fact, this is still the case today.) Our GMVーalso achieving continuous YoY growthーwas more than TWD 681 billion (approximately JPY 3.2 trillion *3), a 26.6% increase year-over-year.

Also popular in Taiwan are LINE POINTS that users earn with every LINE Pay payment they make. In 2023, TWD 7.2 billion (JPY 33.8 billion *3) worth of LINE POINTS were issued, and users impressively spent them all, which was a major achievement.

Taiwan's going cashless

―― Is Taiwan's cashless market also growing?

In short, yes. In 2017, the Taiwanese government announced a goal to increase the penetration rate of cashless payments to 90% by 2025, showing their commitment to popularize cashless payments in Taiwan both online and offline. Their proactive policy promotions have included not only expanding payment locations but also exempting businesses from using uniform invoices (*4) as well as reducing the VAT (*5) from the usual 5% to 1%, all to encourage SMEs to start accepting cashless payments.

According to Taiwan's Financial Supervisory Commission (equivalent to the FSA in Japan), approximately 6.912 billion cashless payment transactions had been made with a credit card, prepaid card, or other cashless means by the end of 2023. Furthermore, their total transaction value was around TWD 7.27 trillion (approximately JPY 34.2 trillion *3), a 17.8% YoY growth, representing the high growth rate of the cashless market itself.

*3 Based on the exchange rate of the day of the interview.

*4 A regulated mandatory invoice system for businesses operating in Taiwan. Original name: 統一發票.

*5 Value Added Tax.

What makes LINE Pay the number one payment service in Taiwan

――Please tell us how LINE Pay became the number one mobile payment service in a growing cashless market.

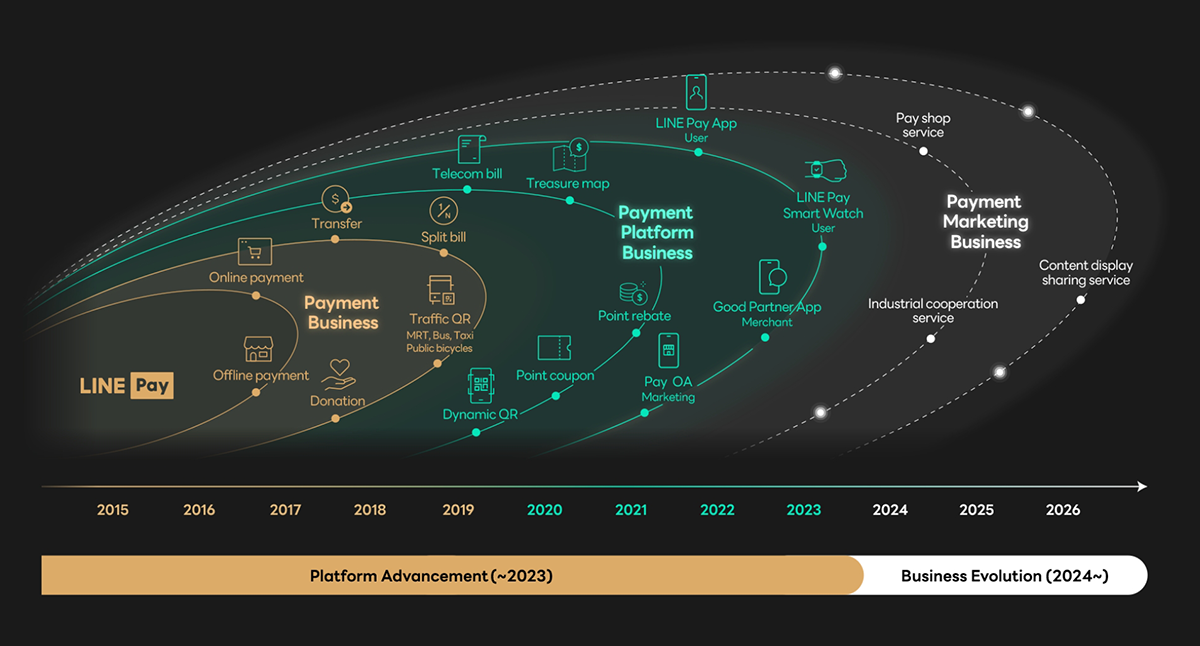

Since launching LINE Pay in 2015, we have been focusing on various fields to build a LINE Pay ecosystem. So far, our biggest milestone has been the issuance of co-branded credit cards in partnership with several of Taiwan's top banks.

In 2016, we partnered with one of Taiwan's largest banks, CTBC Bank, and started issuing CTBC LINE Pay co-branded card. The card comes with a point reward program that instantly gives a percentage of every transaction back to the LINE Pay user in LINE POINTS, and the Points worth TWD 1 each can be spent from the next payment. When the cards were first introduced, the point reward rate was 3% on all purchases including domestic which no other industry player could match at the time. This was met with a strong market response.

Furthermore, we designed the cards with LINE FRIENDS characters and conducted other aggressive marketing campaigns that steadily attracted more customers. Such cumulative efforts led to 5.4 million card issuances by 2023, making the CTBC LINE Pay co-branded card the most issued credit card in Taiwan.

Following this success, in 2019 we decided to partner and begin issuing LINE POINTS reward cards with two more banksーTaipei Fubon Bank and Union Bank of Taiwan. By the end of 2023, we had issued a cumulative total of more than 7 million cards with the three banks, and these cards have been fulfilling a fundamental role in the LINE Pay ecosystem by generating LINE POINTS for every transaction. To further expand our financial ecosystem, we have partnered and started issuing LINE POINTS reward credit card with Bank SinoPac from April of this year.

- Point reward rate of each card (all transactions are eligible with no value limit)

- LINE Pay co-branded card: 1% on domestic transactions, 2.8% on foreign transactions, and up to 17% on transactions with participating shops and brands

- J Card: 1% on domestic transactions, 3% on transactions made in Japan or South Korea, and up to 10% on transactions with participating shops and brands in Japan and South Korea

- Lai Dian card: 1.68% on domestic transactions, 2.68% on foreign transactions, and up to 10% on transactions with participating restaurants

- DAWAY card: 1% on domestic transactions, 2% on foreign transactions, and up to 3% for new cardholders

――Please tell us more about the marketing campaigns.

At LINE Pay, we run more than 600 marketing campaigns a year under the slogan, "Everyday LINE Pay Day." With the goal of offering benefits to users and merchants every day, we collaborate with business partners to run campaigns that reward users with LINE POINTS and encourage them to spend the Points they earn.

―― 600 marketing campaigns a year is incredible. That's two campaigns a day. How are these campaigns planned and executed?

We of course weren't running over 600 campaigns annually from the start. With a limited budget and resources, running frequent campaigns on our own was impossible. Therefore, we decided to first focus on attracting businesses seeking to take advantage of our vast user base for their promotions.

We made sure that things like the budget, timing, and target of our marketing proposals were meeting the needs of the business partners, and, after every campaign we thoroughly analyzed the results so that there would always be improvements to suggest for the next campaign. It was by repeating such a cycle for several years that we were able to gain our business partners' trust and eventually run 600 marketing campaigns in 2022. Ever since, the annual number of marketing campaigns has been increasing every year.

Even during COVID-19 when other payment providers saw their transaction volume plummet, ours continued to increase through promotional campaigns with partners. In fact, we had increased the number of collaborative relationships we have with business partners during the pandemic.

Examples of past marketing campaigns

Cumulative efforts that built the user base

――What other services does LINE Pay offer?

We operate a variety of services to offer convenience and support to our users. The Financial Platform is a one-stop service that lets users use their LINE Pay account to settle insurance premiums as well as search and apply for credit cards, loans, and insurance products. The Treasure Map lets users use a map to look up LINE Pay merchants, browse through current hot deals, and download coupons.

To our merchants we offer services such as the LINE Pay Marketing Platform and the Good Partner App that are especially designed to help SMEs and new merchants maximize the efficiency and effectiveness of their LINE Pay-backed marketing campaigns.

――I'm starting to see how LINE Pay has earned its number one market position by offering a multitude of beneficial services to both users and merchants.

Admittedly, the existing popularity of the LINE app gave us an advantage when we launched LINE Pay because users could access our service without having to download a separate app and this lowered the barrier to entry. However, in order to make payments with LINE Pay, users still need to register things like their bank account details and credit card information which is a big hurdle. We couldn't expect people to complete this step unless the time and effort were worth it.

For this reason, I am confident that LINE Pay's current user base of 12 million is largely a result of our cumulative efforts issuing co-branded card and POINTS rewards cards with major banks, running promotional campaigns with partners, and offering convenient and beneficial services to our users.

Taiwan's unique triple barcode and popular smartwatch features

――What are some of LINE Pay's specifications and usage in Taiwan that might be different from other markets?

The Taiwanese version of LINE Pay lets users choose from a selection of payment screens according to their needs. Probably the most unique is the "triple barcode" that shows three barcodes in one screen: a membership barcode (it could be for a convenience store, a coffee shop, or other establishment), the e-invoice commonality carrier-mobile barcode, and a payment barcode. In the early days, users had to show their membership barcode on a separate app whenever they needed it before displaying their LINE Pay barcode to pay, and this was a common inconvenience based on the user feedback we were receiving. It was upon discovering this pain point that we decided to develop the triple barcode screen that consolidates the barcodes users need into a single screen.

Some employees were initially against the idea of showing three barcodes on one screen from a UI and UX perspective. However, in the end we all agreed that the opinion that should matter most is that of our daily active users and went ahead with the release. We're glad we did because the triple barcode screen has been receiving positive feedback from a lot of users. Regarding displaying membership cards, we are humbled to know that many users are appreciating being able to use LINE Pay barcodes even when their payment method is not LINE Pay.

At LINE Pay Taiwan, we value user feedback and have weekly meetings to review and discuss what our users are saying about our services. There's no prouder moment when we receive positive reviews on product improvements we've made based on users' comments. It's a company culture that we'd like to preserve.

- Fast mode: Automatically displays recently used barcodes.

- Standard mode: Users can swipe right and left to find and display the cards and barcodes they need as well as configure settings.

- All-in-one mode: Shows three barcodes in one screen. Users can set frequently used barcodes as their default.

- Full-screen barcode: Users can tap to enlarge the barcode that is displayed, or swipe left and right to switch between barcodes.

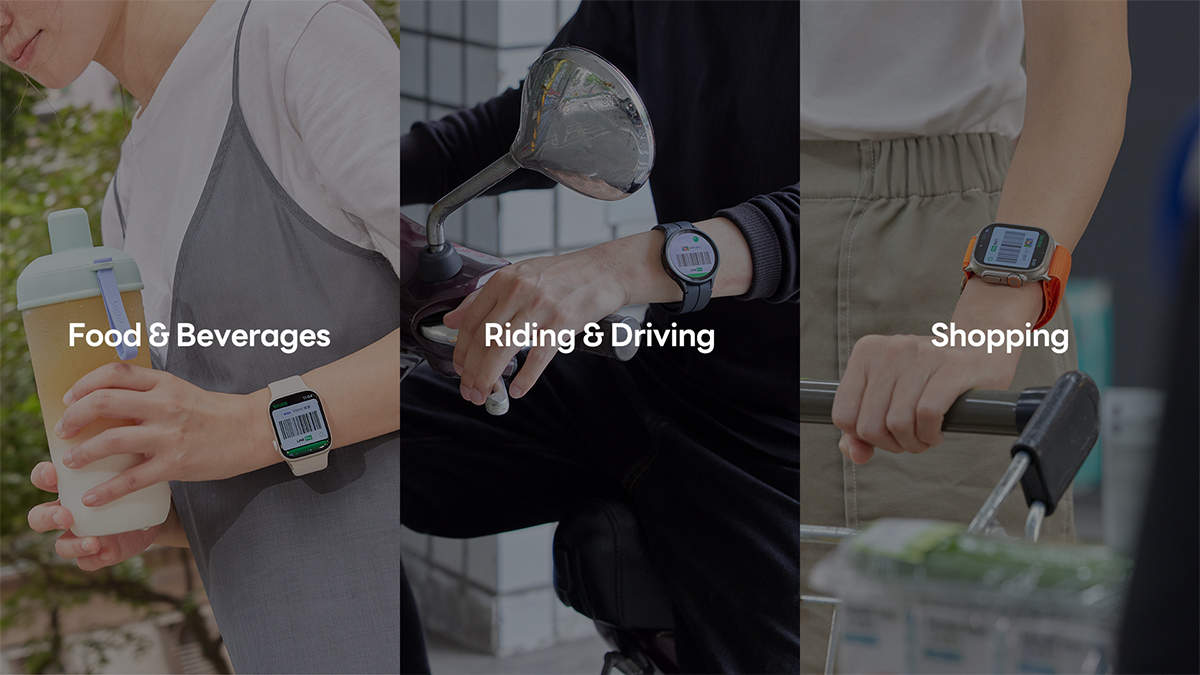

The smartwatch feature that we released in June 2023 has also been well received, particularly among university students and the younger generation. We believe that this could be connected to several factors. First, being stylish and cool as well as having one's own unique style are generally considered important among young people. Second, Apple Watches are also popular in Taiwan, and it seems users enjoy making LINE Pay payments with their smartwatch. Third, a lot of people in Taiwan ride a motorcycle every day, and the bikers seem to appreciate being able to pay for gas with their smartwatch and not having to pull out their phone every time.

Challenges in going public

―― What does it mean for LINE Pay Taiwan to become listed on the stock exchange?

While our goal is to become officially listed on Taiwan's stock exchange, some are doubting our capability of growing further as the only company in the cashless market to be maintaining positive growth and profitability. For these reasons among others, this year will be a challenging year for us as we prepare to go public, but we intend to dispel market concerns and grow our services by reinforcing our business partners' and users' trust in order to become listed.

To ensure a successful listing, we will be increasing the number of payment locations as well as attractive offers for users and merchants. We will also be focusing on inbound and outbound business. As a matter of fact, we are in the process of partnering with Korea's largest credit card company as well as duty-free shops in hopes of offering our users a better payment experience both in and outside of Taiwan.

Finally, we will continue to analyze users' day-to-day needs, listen to user feedback, and keep improving our services to offer better user experiences.

Once we become a publicly traded company, the user ecosystem that we will have spent ten years building with our LINE Pay users will be the foundation upon which we will spend the next ten years building a merchant ecosystem with our LINE Pay merchantsーSMEs in particular. The day the user and merchant ecosystems combine will be the day the LINE Pay ecosystem will be complete in its true form. We want to build a sustainable system in which LINE Pay will be an essential service for both users and merchantsーoffering convenience to users and contributing to merchants' business growthーwhile also growing as a result of the system.

From left: LINE Pay Taiwan Chairman and CEO Jeong, Senior Vice Presidents Celeste and Gloria, and Executive Vice President Harris

LINE Pay Taiwan's history and future vision

Interview date: March 14, 2024

Note: The information covered in this article is current as of the interview date.

- About The LY Corporation Story

- Making daily life more convenient and exciting for everyone.

As our corporate blog, The LY Corporation Story will share the inside story behind the challenges that we take on to create WOW! as well as the thoughts and feelings behind them.